Ad Answer Simple Questions To Make Your Partnership Worksheet. Scroll down to the FinalAmended section.

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Check boxes on 1a and 1a1 ii.

. UltraTax CS will then produce the Form 8960 Line 5c Adjustment from disposition of partnership interest or S corporation stock worksheet on Form 8960 Net Investment Income Worksheet 2 and. Holding period requirements for longshort term. If this is a full.

The basis of partnership assets will be adjusted under section 743b upon the sale or exchange of a partnership interest in two situations. Amys membership interest is 13 of the LLC. Also where a Code Sec.

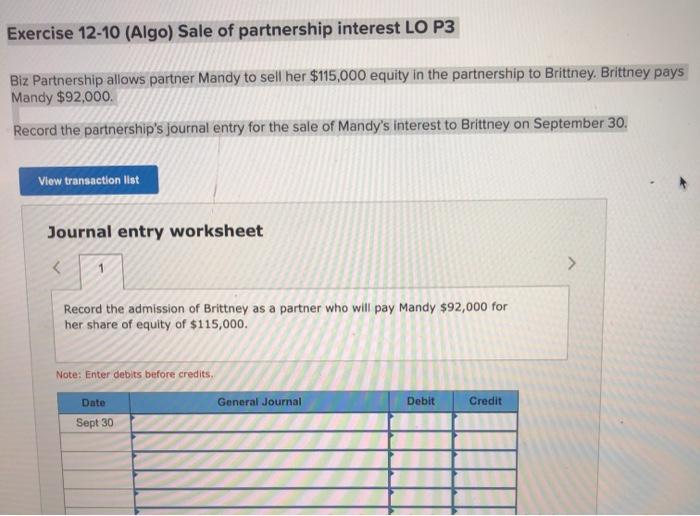

751 assets a sale or exchange of a partnership interest is looked through and the gain or loss on the portion allocable to those assets is treated as ordinary income or loss. Basis in the partnership. Sale of Partnership InterestSale of Partnership Interest General Rule IRC 741 A sale of partnership interest is a sale of a capital asset.

Create Legal Documents Using Our Clear Step-By-Step Process. Collaborate Effortlessly With Any Office Suite For the Editing Process. Amy is a member of ABC LLC and has a 23000 basis in her interest.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. When a partner disposes of an interest in a partnership the difference between the sale price and the adjusted basis is the taxable gain loss. - The partnership has made a section 754 election that is.

Click on the QuickZoom button then to Part II Disposition of Partnership Interest i. Given the facts listed in the table below calculate the selling partners taxable gain. The Practice Unit on sales of partnership interests provides a readily-usable tool to taxpayers who sold partnership interests and who are subject to IRS examination.

Check the box for Partner sold. Check to be sure box D is checked indicating this is a publicly traded partnership. Partnership capital accounts reflect a partners economic investment The value of a partnership interest can be determined assuming a hypothetical sale of the partnership assets at their fair-market.

Partner sold or otherwise disposed of entire interest box. The partners adjusted basis is used to determine the amount of loss deductible by the. Ad Free Customized Business Sale Agreement Forms.

From the Schedule K-1 Partnership 2014 Form 1065 Additional Information worksheet in the TurboTax program Instructions on reporting Disposition of Partnership Interest. Do not attach the worksheet to Form 1065 or Form 1040. Open the Partnership Schedule K-1 Worksheet.

Ad Our High-Quality Fill-In-the-Blank Templates Are Created By Business Experts Lawyers. The buyers outside basis in the. How do I calculate basis of partnership interest from a stock trade.

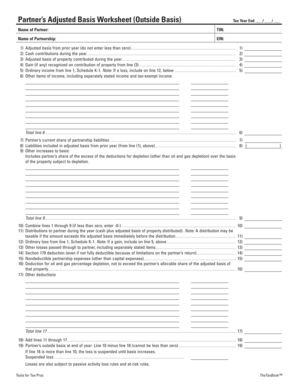

Because a partnership is a pass-through entity it would be logical to assume that a sale of interests in the entity would be taxable in. To assist the partners in determining their basis in the partnership a worksheet for adjusting the basis of a partners interest in the partnership is found in the Partners Instructions for Schedule K-1 Form. There is a worksheet for adjusting the basis of a partners interest in the partnership in the Partners Instructions for Schedule K-1 Form 1065.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. A partner with a 13 interest in a partnership sells his interest for 50000. Ad Free Customized Business Sale Agreement Forms.

Installment reporting for sale of partnership interest. See Tab A for a blank worksheet. Sale of Partnership Interests.

Sale of Assets vs. Sale of partnership interest Gain or loss from the sale of a partnership interest equals the difference between the amount realized and the adjusted basis. It is in very general terms the cost you paid for the partnership interest plus the.

Many times the K-1 will show the basis. Note that the partner basis worksheet does not export with. Example 2 Sale of partnership interest with partnership debt.

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Solved Assessment 4 Partnerships 2 Exercise 1 Worksheet Chegg Com

Instructions For Form 8990 05 2020 Internal Revenue Service

Partnership Taxation What You Should Know About Section 754 Elections

Advantages Of An Optional Partnership Basis Adjustment

Rev 999 Partner S Outside Tax Basis In A Partnership Worksheet Free Download

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Solved Exercise 12 10 Algo Sale Of Partnership Interest Lo Chegg Com

Instructions For Form 8990 05 2020 Internal Revenue Service

Advantages Of An Optional Partnership Basis Adjustment

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Solved Assessment 4 Partnerships 2 Exercise 2 Worksheet Chegg Com

ConversionConversion EmoticonEmoticon